Christmas Gifting

Mega Deals

Clubs

Clothing

Shoes

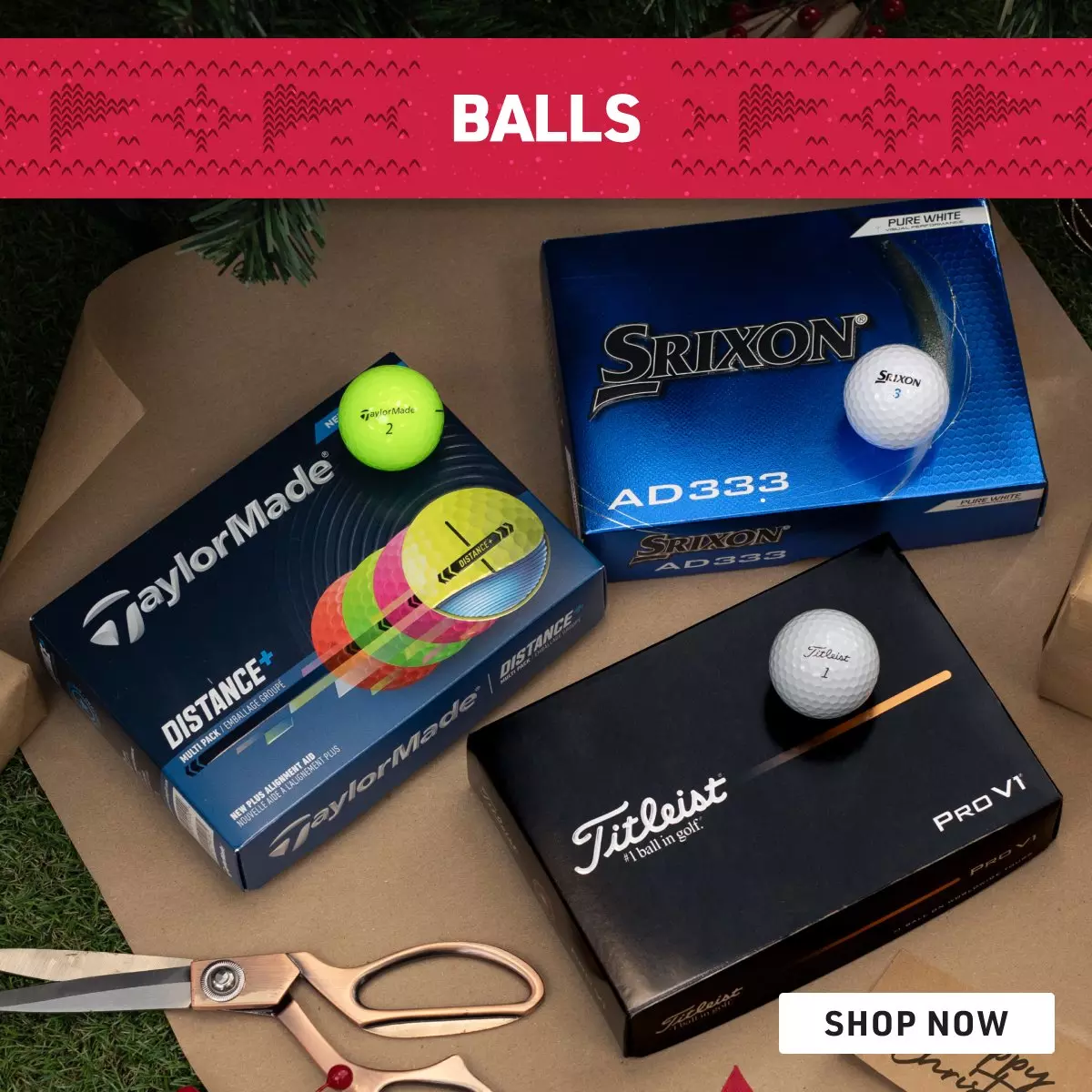

Balls

Bags

GPS

Trolleys

Accessories

Sale

Brands

Book Custom Fit

Personalised Golf Products

Christmas Gifting

Mega Deals

Clubs

Clothing

Shoes

Balls

Bags

GPS

Trolleys

Accessories

Sale

Brands

SHOP NOW

FAQ

Once your finance application has been accepted, you are required to read and sign your loan agreement documents electronically.

Once the documents are signed, the order is complete and your goods will be ready to deliver.

Credit scoring is the process used by financial services companies to evaluate the credit risk of new applicants. This technique will be applied to your application for online finance. Credit scoring works by awarding points for each answer given on the application form such as age, income and occupation, together with information obtained from credit reference agencies. This information allows us to produce consistent decisions, ensuring all our applicants are treated fairly. Credit scoring does not discriminate on the grounds of sex, race, religion or disability.

In addition to credit scoring, V12 Finance also take into account confirmation of your identity, validation of certain application details, existing commitments and information held at the credit reference agencies. Though V12 Finance are unable to provide you with a main reason for decline of your application, it is usually based on one, or a combination of the following:

- Your credit score (note that every finance company will score you differently)

- Adverse credit reference agency information

- You are considered to be overcommitted

- You are aged under 18

Some of the information is public information, for example electoral roll, County Court Judgements and bankruptcies. Other lenders may also file information about accounts you hold with them for instance this could include your payment history and outstanding balance on these accounts. Any requests for credit, where a credit reference search has been undertaken, will also be filed, although the result of the request is not recorded.

You should send a cheque for £2.00 made payable to the relevant company, together with details of all addresses at which you have lived over the last 6 years:

-

Consumer Help Desk Experian Limited PO Box 8000 Nottingham NG1 5GX

-

Equifax Ltd., Credit File Advice Centre. PO Box 1140. Bradford, BD1 5US

-

Consumer Services, Callcredit Limited, PO Box 491, LEEDS, LS3 1WZ

The above listed agencies will provide details of information relating via these addresses. If you believe that the information is incorrect, you can ask the agency to correct it.

Yes. V12 Finance acknowledge that your circumstances change and just because V12 Finance have refused a previous application, it does not mean that V12 Finance will automatically turn down a further request. V12 Finance do suggest however, that you leave at least 6 months between applications.

You must be 18 or older, be in permanent paid employment, self-employed, retired and receiving a pension, working student in part time work or in receipt of a disability benefit, has been a resident in the UK for at least 3 years, has a debit or credit card in their name, which is registered to their address, in order to pay for the deposit (if applicable) and has a Bank or Building Society current account available (you’ll need this to complete the direct debit instruction) We don’t permit Owners, Directors, Partners, Sole Traders to obtain finance to purchase goods from their business. If an employee is applying for finance to purchase goods through their employer, they must seek permission from their line manager who must then process the application. Note: finance is not available for unemployed individuals. Applications that have previously been rejected should not be re-proposed within a 3-month period.

In order to safeguard against fraudulent applications, V12 Finance regret that they're able only to deliver goods to the home address of the applicant.

Terms & Conditions

All finance agreements are a contract between you “the customer” and V12 finance.

To apply for finance you must:

You must be 18 or older, be in permanent paid employment, self-employed, homemaker, retired and receiving a pension, working student in part time work or in receipt of a disability benefit, has been a resident in the UK or Jersey for at least 3 years, has a debit or credit card in their name, which is registered to their address, to pay the deposit where applicable, has a Bank or Building Society current account available (this is required to complete the direct debit...